When Remittance Became Resistance, Bangladeshi Diaspora Deserves Voice

By cutting remittance flows during the July 2024 revolution, Bangladeshi expatriates proved they are not just economic players—they hold power to drive change and deserve a voice in rebuilding nation.

প্রবাসীরা কি শুধু অর্থনীতির চালিকাশক্তি, নাকি ভবিষ্যত বাংলাদেশের রাজনৈতিক কৌশলের অন্যতম স্তম্ভ? জুলাই '২৪-এ শিক্ষার্থী-জনতার আন্দোলনে প্রবাসী বাংলাদেশিরা রেমিট্যান্স বন্ধের ডাক দিয়ে যেভাবে স্বৈরাচারী শাসনের ভিত কাঁপিয়ে ইতিহাসের মোড় ঘুরিয়ে দিয়েছিল, তার নিরিখে এ প্রশ্নের উত্তর খুঁজুন লেখাটিতে।

Diaspora and expatriate communities often maintain strong emotional, economic, and political ties to their home countries through cultural traditions, remittances, and civic engagement. Their influence is visible in family support, humanitarian aid, and raising awareness about national issues on the international stage. Yet the true extent of their power—especially to shape political events—often remains underestimated. Can these connections drive major political transformation? The experience of Bangladesh in 2024 offers a powerful answer. During the July revolution, Bangladeshis abroad leveraged remittance as resistance to challenge a 15-year authoritarian regime and redefine their role in shaping the nation’s future.

On July 17, 2024, the Sheikh Hasina regime suspended all mobile internet services and imposed a curfew to suppress the protesters and activists of the ongoing anti-quota movement. This move disconnected the country from the rest of the world and outraged the Bangladeshi diaspora worldwide, a relatively affluent and politically engaged community that relies on internet services to stay in touch with their family and friends back home. The sudden blackout caused widespread panic, especially about the safety of their loved ones amid the heightened political tensions. Who could have anticipated that their fury would ignite a turning point in Bangladesh’s looming revolution.

The anger of the Bangladeshi diasporas and migrant workers intensified. Many among them had left Bangladesh during the past 15 years, fleeing political persecution under the Hasina regime, while their families back home often lived under surveillance and threats. In an unprecedented response, the diaspora community spontaneously began circulating a call on social media to stop sending remittance to Bangladesh. It was unclear who initiated the call, but it quickly gained momentum.

The impact was very swift. The regime’s then ICT minister publicly pleaded for the diaspora to continue sending remittances and subsequently restored internet access, showing that the expatriate community could exert real influence. Remittances were the most immediate and impactful economic tool available to them—one they used effectively, especially because Bangladesh’s economy heavily relies on remittance inflows to sustain its foreign currency reserves. This action exposed the regime’s vulnerability, and the video of the ICT minister’s plea quickly went viral, adding further fuel to the domestic protests. It revealed a striking reality: even from afar, the Bangladeshi diaspora holds significant economic power capable of shaking a seated authoritarian regime to its core.

An Overview of Bangladeshi Diaspora and Expatriates

International Organization for Migration (IOM) defines the diaspora as people whose sense of belonging and identity are shaped by migration. These are individuals living abroad who maintain strong connections to their home country. Expatriates, in contrast, are people who go abroad primarily for work but often remain uncertain about the duration of their stay. In this article, we regard both groups similarly, as both contribute significantly to Bangladesh’s remittance flows and have demonstrated their political influence, as seen during the July 2024 uprising.

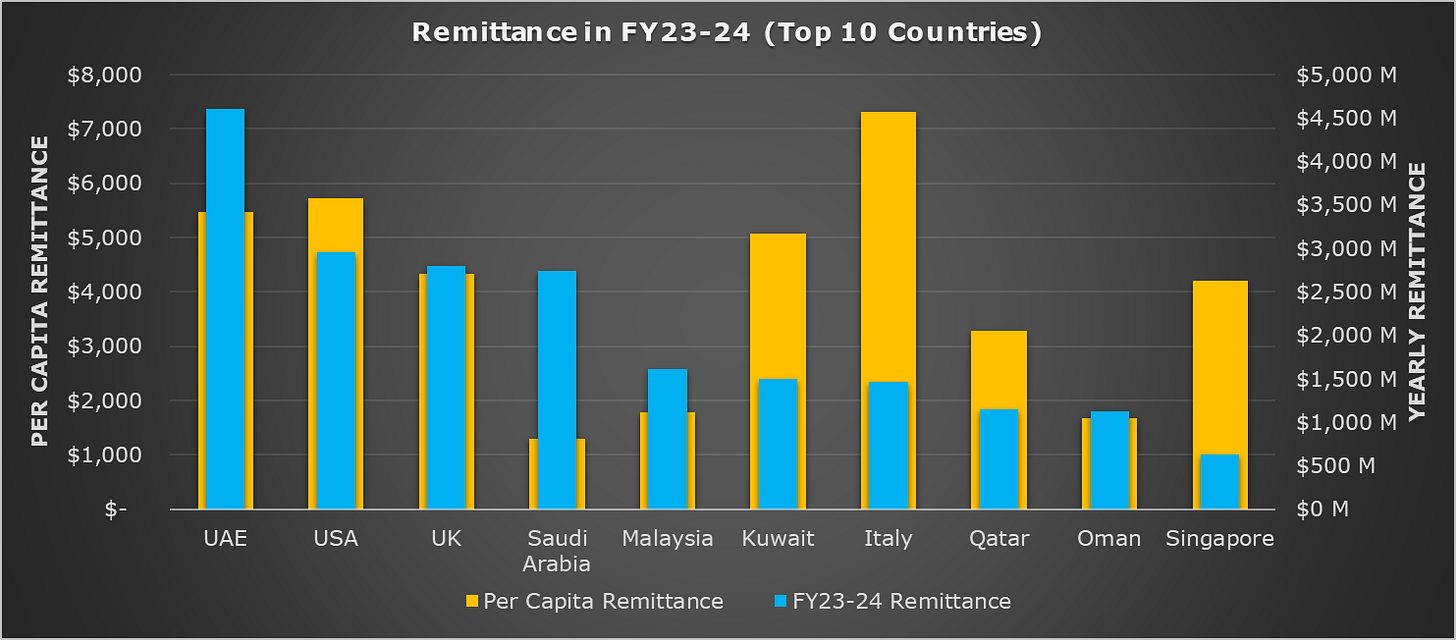

Bangladesh’s Remittance sources are concentrated in a few countries. In FY 2023-24, about 86% of wage earners’ remittances came from just ten countries (see figure above), sent by a migrant population of only 6.6 million. Remarkably, 60% of this population resides in just three countries: Saudi Arabia, Malaysia, and the United Arab Emirates (UAE).

The figure below provides a detailed picture of how much foreign currency Bangladesh receives from these 10 countries. In FY 2023–24, Bangladesh received a total of $23.91 billion in remittances, with $20.57 billion—nearly 86%—originating from these ten countries. The United Arab Emirates was the top sender, followed by the USA and UK.

Although the UAE hosts the third-largest share of Bangladeshi migrants, it topped the list in remittance volume during FY 23-24. Kuwait, Italy and Singapore hold the same number of people, but they recorded the highest per capita remittances, while Saudi Arabia and Malaysia bottom the list. The per capita remittance shows where Bangladesh’s highest wage earners live. Knowing the top remittance senders and their amount of contribution warrants a closer look at the economy of Bangladesh, which will make it clear how important the remittance is for the country’s economic stability.

Bangladesh Economy’s Snapshot and Remittances

A full macroeconomic overview of Bangladesh’s Economy is beyond the scope of this article. However, a brief look at the role of remittances gives important insight into why the Hasina regime made public apology and quickly restored internet services to establish remittance flows when they were threatened. In what follows, we focus mainly on wage earners’ remittances.

The figure above shows monthly remittance inflows strongly correlates with the Foreign Exchange Reserve (measured under the BPM6 standard). For example, both remittance inflows and reserves dropped in January 2025.

Modes of import payments are also important because if Bangladesh must pay in cash for most of the imported goods, remittances and foreign currency reserves become very crucial to keep market prices stable. During the last quarter of 2024, 77% of the total import payments of Bangladesh had to be made in cash, while only 21% were covered through buyer’s credit. This trend highlights Bangladesh’s vulnerability: when most imports require immediate payment, it puts immense pressure on foreign exchange reserves.

The figure above, showing a year-over-year comparison, highlights an increase in cash payments and a decline in buyer’s credit. Political instability often drives this trend. In more stable environments, seller confidence leads to longer credit terms, easing pressure on foreign exchange reserves. However, under the Sheikh Hasina regime, the opposite occurred. On May 30, 2023, Moody’s rating for Bangladesh’s credit went down from Ba3 to B1, reflecting diminished confidence in the country’s financial stability.

How dependent is Bangladesh on foreign remittances?

To gauge dependency, we examine three factors: import payments, export receipts and remittances. The figure below shows import payments hover around $15 billion per quarter, while export receipts remain closer to $10 billion. The gap between the two is largely covered by remittance flows to keep the import unimpacted. The same picture is also evident if we look at the balance of payments account: remittances make up nearly 80% of the financing of the current account deficit.

What was the hidden pressure?

The trading partners of Bangladesh are split across distinct groups. Its imports come primarily from China, India, and Indonesia, while its exports are directed largely to the United States, Germany, and the United Kingdom. Meanwhile, remittance inflows originate from politically influential countries such as the United States, Saudi Arabia, and the UAE. This geopolitical entanglement means that remittances indirectly impact not just trade balances but its broader foreign policy alignments.

A disruption in remittance inflows, therefore, would not only impact Bangladesh’s economy, it could also ripple into financial systems in key partner countries, including China and India, two major powers in South Asia. This interconnectedness subtly raises the leverage that the diaspora holds, both domestically and internationally.

The Road Ahead

Bangladesh must focus on diversifying its economy. Dr. Muhammad Yunus and his team have championed such efforts, advocating for increased foreign direct investment (FDI) and broader export expansion. The country also needs leadership capable of tapping into global markets to secure financial inflows beyond just remittances.

If remittance inflows were to collapse—whether due to political unrest, a global economic downturn, or a pandemic-like crisis—the economy could unravel rapidly. The July 2024 boycott served as a wake-up call. The diaspora, long seen as a passive actor, proved itself as a powerful force capable of influencing the nation’s political and economic trajectory.

Bangladesh must recognize this leverage and engage its diaspora not just as a source of remittance, but as strategic partners in building a resilient and inclusive economy.

About the Auhtor:

Zm Talha is a U.S.-based data scientist with a deep interest in Bangladesh’s political and economic development. He brings fresh perspectives to issues of political reform, exploring how the diaspora, politics, economy, and media interact to shape the nation's future. He can be reached at ztalha149@gmail.com.